Table of Contents

Introduction: Top 10 Financial Mistakes to Avoid in Your 30s and 40s

Your thirties and forties are valuable years as far as your financial planning is concerned. These years are typically associated with different important shifts in people’s lives, for instance, career promotion, buying a house, childbearing, and retirement. But it is also a time where disasters happen in terms of financial management, and they produce very long term effects that are hard to solve. Here are the top 10 financial mistakes to avoid during your 30s and 40s:Here are the top 10 financial mistakes to avoid during your 30s and 40s:

1. Not Prioritizing Retirement Savings

Those readers who are in their 30s and 40s do not always focus on the retirement goal. Despite the fact that there might be urgent requirements to meet, like buying a home, funding children’s education, one might make a fatal error of neglecting to save for one’s retirement. What is more, the amount that compounds with the interest draws in even more interest and the longer you delay to save then the weaker the power of the compounding becomes. Saving for 401(k) or IRA and participating in employer matching programs is one of the ways that can assist an individual to amass a great retirement corpus.

Tip: It would be wise to target to save about fifteen percent of your income towards your retirement expenses. If you’re the one who is behind, increase the payments and reduce leakage in order to make up for the lost ground.

2. Flipping a Home and Going overboard

Purchasing a house is one of the biggest financial commitments of most people in their lifetime but this is not a good reason to engage in the buying of a house that one cannot afford. Excessive spending on a mortgage bonds can make the borrower a financial strain from which they can seldom be extricated leaving no room for saving and investment. However, an expensive home leads to high property taxes, maintenance fees, and you have to pay high insurance fees, this is draining financially.

Tip: Adhere to the 28/36 rule of thumb; your house payment, which includes your mortgage, should not exceed one–fourth of your gross monthly income, while the sum of all the monthly installments on debts should not be more than one-third of your income.

3. Neglecting an Emergency Fund

An emergency fund is an amount of money set aside to cater for those unplanned expenses like an illness or other losses such as a loss of job among others or huge house holds repairs. If you do not plan or, or indeed, have no savings at all you may well have to resort to using credit cards or borrowing, consequently, you get into more debts. Sadly, a large number of people recognize insufficient emergency savings as a potential threat only in their productive 30s and 40s.

Tip: It is recommended to maintain minimum three to six months living expenses in an emergency fund which can be held in high yield savings account.

4. Carrying High-Interest Debt

These are usually considered to be very bad debts since they attract high interest charges such as credit card debts which reduce one’s disposable income and hence little is saved or invested. Having balances on credit cards when you are pursuing the next level or taking extremely short-sight loans when you are in your 30s and 40s effectively slows down or stops the creation of wealth and financial freedom.

Tip: Try to avoid debt at all cost as far as possible and / or pay off high interest bearing debts sooner. It is about choosing between the ‘debt snowball’ and the ‘debt avalanche,’ and the common-sense practice of not accumulating additional debts whenever possible.

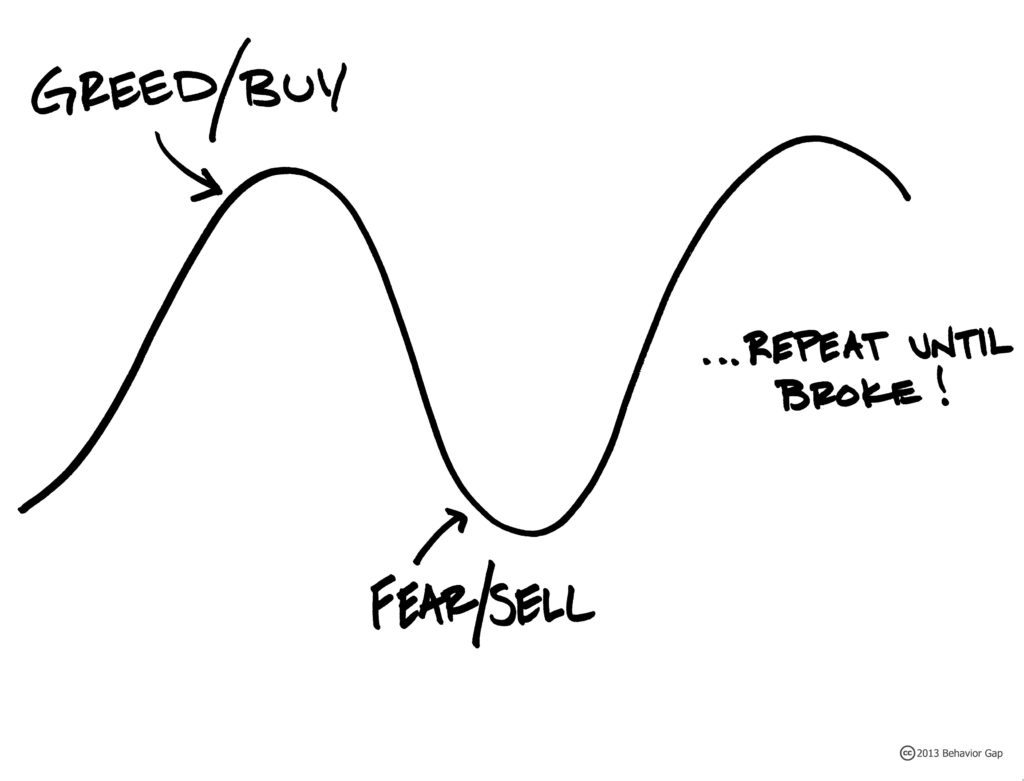

5. Failing to Diversify Investments

For people in their 30s and 40s, it becomes all the more important to concentrate on increasing the money you invest for your future wealth creation. However, if you don’t diversify your portfolio, you put yourself in unnecessary risks. Investing in a single class of assets, say stocks or property, can prove very costly if this type of assets plunge.

Tip: These are matters of expanding the list of managed assets, investing in several asset classes, including shares, bonds, real estate, and overseas investments. This approach shows you how to avoid the dangers and enhance the quality of your portfolio in the long run.

6. Lack of appropriate insurance plan

Insurance can be said to be of paramount importance in any individuals’ financial planning since it can offer cover against disasters that are likely to bring the individuals’ financial situations to their knees. A large number of individuals in the age of 30s and 40s overestimate their insurance requirements or never review such coverage plans at all. Inadequate life, health, disability, or property insurance affects your readiness when you get involved in an accident, get an illness or experience other forms of misfortune.

Tip: Self-insured exposures should be reviewed on reasonable intervals and updated based on the changes in your life situation. To meet financial risks consider having enough life insurance That will help your family, health insurance That will help cater for your medical bills, and disability insurance if you get ill or are disabled and cannot earn for yourself. .

7. Ignoring Estate Planning

Preparation of an estate is not one of the things that people rush to do; you will find young people in particular never a hurry to make an estate. However, the lack of planning in the area of estates is dangerous because it creates the following issues to your relatives and or heirs: If you die intestate, that is without a will or trust, the laws of your state will determine how your property should be divided.

Tip: Establish a fundamental estate plan that comprises of a last will and testament, a power of attorney, and an advance health care directive. Although this seems elementary, if you have children specify their guardians in your will. When your financial conditions are developing, you should create a trust in order to regulate most of the property and to decrease estate taxes.

8. Underestimating Healthcare Costs

Medical expenses are highly probable to increase with an individual’s age, and ignoring these costs is highly likely to stretch one’s financial capacity when they are no longer working. Most of those in their 30s and 40s are concerned about immediate health issues and do not think about their future health care expenses such as long term care.

Tip: If your employer offers a High Deductible Health Plan (HDHP), you may want to explore having a Health Savings Account (HSA); since they have this plan, you get triple tax advantage: the money you contribute to the HSA is pre-tax dollars, the money grows tax deferred or tax free, and when you withdraw the money for qualified medical expenses, you do not pay taxes. Furthermore, start thinking about long term care insurance, particularly when you get you to the age of 40s.

9. OPTIONS and their failure to plan for Children’s Education Costs

On this topic, OPTIONS has not given much consideration on the aspects of Children’s education costs and the following are the detailed explanation on options’ shortcomings.

Since one of the major expenses of families is for children, another factor, which should be taken into consideration, is the costs of education. The college tuition keeps increasing and if one is not careful as they are attending college, they may end up in incurring some serious amount of debt or they end up spending the amount of money that should have gone for any other financial priority such as more united savings.

Tip: Begin saving for your children’s education as early as possible and get a tax preferred account as is 529 plan. Besides contributing to their education it is always important to save for your retirement and the bad news is that you cannot borrow to pay for your retirement.

10. To be more specific, four problems have emerged: overlooking the importance of financial education.

A financial literacy is essential if one is to make sound decisions on how to handle his or her money. But tens of thousands of people aged between 30-40 years do not read personal finance literature, they rely on old knowledge, or they decide badly not knowing the consequences of that decision.

Tip: Spend time in developing your understanding of the financial concepts. One can read the books, attend seminars or seek the services of a financial expert to enable them understand issues such as investing, retirement, taxes, and estates among others. The more information you have the better you stand to minimize bad decisions and make good economic decisions.

Conclusion

As we move from your 30’s and 40s are crucial years in as much as we seek to create a secure financial future. If you want to start building wealth immediately, it is about time that you discontinue the said financial blunders in so far as your financial freedom and prosperity in the future is concerned. Creating and funding a retirement plan, paying off loans, expanding one’s investment portfolio, and(readily) obtaining knowledge about personal finance help you get through these years strong and set up financial success in the future.

FAQs on “Top 10 Financial Mistakes to Avoid in Your 30s and 40s”:

1. Why is it important to avoid financial mistakes in your 30s and 40s?

Avoiding financial mistakes in your 30s and 40s is crucial because these decades often involve significant life changes, such as career growth, home ownership, and family planning. Missteps during this time can have long-lasting effects on your financial security and retirement plans.

2. What are the most common financial mistakes people make in their 30s and 40s?

Common mistakes include not prioritizing retirement savings, overextending on a home purchase, carrying high-interest debt, and neglecting an emergency fund, among others.

3. How much should I be saving for retirement in my 30s and 40s?

Financial experts generally recommend saving at least 15% of your income for retirement. If you’re behind, consider increasing your contributions and reducing discretionary spending.

4. What is the 28/36 rule in home buying?

The 28/36 rule suggests that your mortgage payment should not exceed 28% of your gross monthly income, and your total debt payments should not exceed 36% of your income. This helps prevent overextending on a home purchase.

5. Why is carrying high-interest debt in your 30s and 40s a mistake?

High-interest debt, such as credit card debt, can drain your finances and make it difficult to save or invest. Paying down this debt should be a priority to avoid long-term financial strain.

6. How important is it to have an emergency fund?

An emergency fund is vital as it provides a financial cushion in case of unexpected expenses, such as medical emergencies or job loss. Without it, you may need to rely on debt to cover costs.

7. How much should be in my emergency fund?

Aim to save at least three to six months’ worth of living expenses in an emergency fund, stored in a liquid and easily accessible account.

8. What are the risks of not diversifying investments in your 30s and 40s?

Failing to diversify your investments can expose you to significant risks if one asset class underperforms. A well-diversified portfolio helps manage risk and improve long-term returns.

9. Why is having adequate insurance coverage important in your 30s and 40s?

Adequate insurance coverage, including life, health, and disability insurance, protects you and your family from financial hardship in the event of unexpected events like illness, injury, or death.

10. What is estate planning, and why is it important?

Estate planning involves preparing for the distribution of your assets after your death. It ensures that your assets are distributed according to your wishes and can help minimize estate taxes and legal complications for your heirs.

11. How can underestimating healthcare costs affect my financial future?

Underestimating healthcare costs, especially as you age, can lead to financial strain. Planning for these expenses through savings, insurance, and HSAs can help protect your financial well-being.

12. Why is planning for children’s education costs important?

Failing to plan for education costs can lead to significant debt or divert funds from other important goals like retirement. Starting early with a 529 plan or similar savings vehicle is essential.

13. How does high-interest debt impact my ability to retire early?

High-interest debt reduces your disposable income, making it harder to save for retirement and potentially delaying your ability to retire early. Paying off this debt should be a priority.

14. What is the impact of not having a financial plan in your 30s and 40s?

Not having a financial plan can lead to disorganized finances, missed opportunities for saving and investing, and unpreparedness for future expenses. A comprehensive plan helps guide your financial decisions.

15. How can I avoid lifestyle inflation in my 30s and 40s?

Avoiding lifestyle inflation involves resisting the urge to increase spending as your income grows. Instead, focus on saving and investing the additional income to build long-term wealth.

16. Why is financial education important in your 30s and 40s?

Financial education helps you make informed decisions about saving, investing, and managing debt. Staying informed reduces the likelihood of making costly mistakes.

17. How does overextending on a home purchase affect my finances?

Overextending on a home purchase can lead to financial stress, leaving little room for saving or investing. It can also increase your risk of foreclosure if you’re unable to keep up with mortgage payments.

18. What are the consequences of not reviewing and updating insurance coverage?

Failing to review and update insurance coverage can leave you underinsured, exposing you to significant financial risks. Regularly assessing your coverage ensures it meets your current needs.

19. How can I catch up on retirement savings if I’m behind?

If you’re behind on retirement savings, consider increasing your contributions, reducing expenses, and taking advantage of catch-up contributions if you’re over 50.

20. Why is it a mistake to delay starting retirement savings in your 30s?

Delaying retirement savings reduces the time your money has to grow through compound interest, making it harder to reach your retirement goals and potentially requiring larger contributions later.

21. How can I ensure I’m properly diversified in my investments?

To ensure proper diversification, spread your investments across different asset classes, such as stocks, bonds, real estate, and international markets, to reduce risk.

22. What should I include in my estate plan?

A basic estate plan should include a will, power of attorney, healthcare directive, and possibly a trust. This ensures your assets are distributed according to your wishes and can help minimize taxes and legal complications.

23. How can I prevent overspending in my 30s and 40s?

Prevent overspending by creating and sticking to a budget, tracking your expenses, and setting financial goals. Avoid lifestyle inflation and focus on saving and investing.

24. What are the benefits of having a Health Savings Account (HSA)?

An HSA offers triple tax benefits: contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are tax-free. It’s a valuable tool for managing healthcare costs.

25. How can I stay motivated to avoid financial mistakes in my 30s and 40s?

Staying motivated involves setting clear financial goals, regularly reviewing your progress, educating yourself on personal finance, and seeking advice from a financial planner when needed.

Also visit:-