Table of Contents

Introduction: The Ultimate Guide to Financial Planning for Single Parents

Budgeting is one of the most important factors of life since people at some point in their lives or permanently may be facing these difficulties, for example, single parents. As a single parent, finding ways and means of juggling the financial responsibilities of the home, while clearly the chores of child rearing, can be so daunting and unendurable, yet such a situation does not have to be as difficult as it appears in the process of child rearing. Read through this guide to know the general procedures to financial planning particularly for single parents.

1. Assess Your Financial Situation

The initial activity of any strategic financial management is the evaluation of the initial financial position. To do this, make sure you begin by making a comprehensive list of all the sources of your income, expenditure, possessions as well as debts. This is what constitutes setting the financial perspective in order to align on a plan that is going to be efficient for the person in point.

Income: Discuss all amounts that you receive in a given period whether it is in form of wages, child support, alimony, government or any other form of benefits.

Expenses: Divide your daily, weekly or other frequent spending on shelter, energy, food, child care, transport, insurance and other obligatory expenses by the month.

Assets: Jot down your balances in the savings and checking accounts, mutual funds, IRAs, and other vehicles for accumulating funds for retirement, as well as other assets such as a car, house, and the like.

Liabilities: They embrace credit card balances, student loans, car loans, and mortgages among others.

When you are able to have a financial blueprint of your resources, it helps you realized that you need to cut down your expenses or earn more revenue.

2. Create a Realistic Budget

For any kind of financial strategy, a budget is the key essential tool. Single parents in particular ought to devise a budget that is appropriate to their situation in order to avoid getting off track. Follow these steps to create a realistic budget:Follow these steps to create a realistic budget:

Track Your Spending: Review your spending for several months since the information is more reliable than when it is produced on a small scale. Do keep track of your expenses using the use of a budgeting app or even a simple excel sheet, then categorize the expenditure.

Set Priorities: Determine the bare bone necessities in your life, which may include; shelter, food, and child care. Those are the ones that should be given priority in ones expenditure.

Allocate Funds: You can split your income into group, such as rent/mortgage, food, savings, credit card payments and others. Stay practical when you are making the decision in regard to the amount that you can afford in a particular category.

Plan for Irregular Expenses: Do not forget what we might call odd expenses which include but not limited to medical bills, car maintenance, or back to school expenses. This is why it is wise to set aside some money monthly to cater for these surprises if at all you have to spend it.

As far as possible, ensure that you closely adhere to the budget, but at the same time do not become to rigid so as to lock yourself out of flexibility in emerging situations.

3. Build an Emergency Fund

It is always recommended to have an emergency fund and even more so for single parents. This is a fund which comes in handy when the unthinkable happens, for instance, the loss of a job, a sickness, or when the house needs a major repair job.

How Much to Save: Ideally, the targeted amount in this category should stand anywhere between three and six months of the living expenditure. It should be sufficient to cater for basic needs such as house rent or house loans, rates and taxes, food, and fuel.

Where to Keep It: The emergency fund should also be easy to manage and preferably in a high yield saving account, from where the funds can easily be withdrawn in the instance of an emergency.

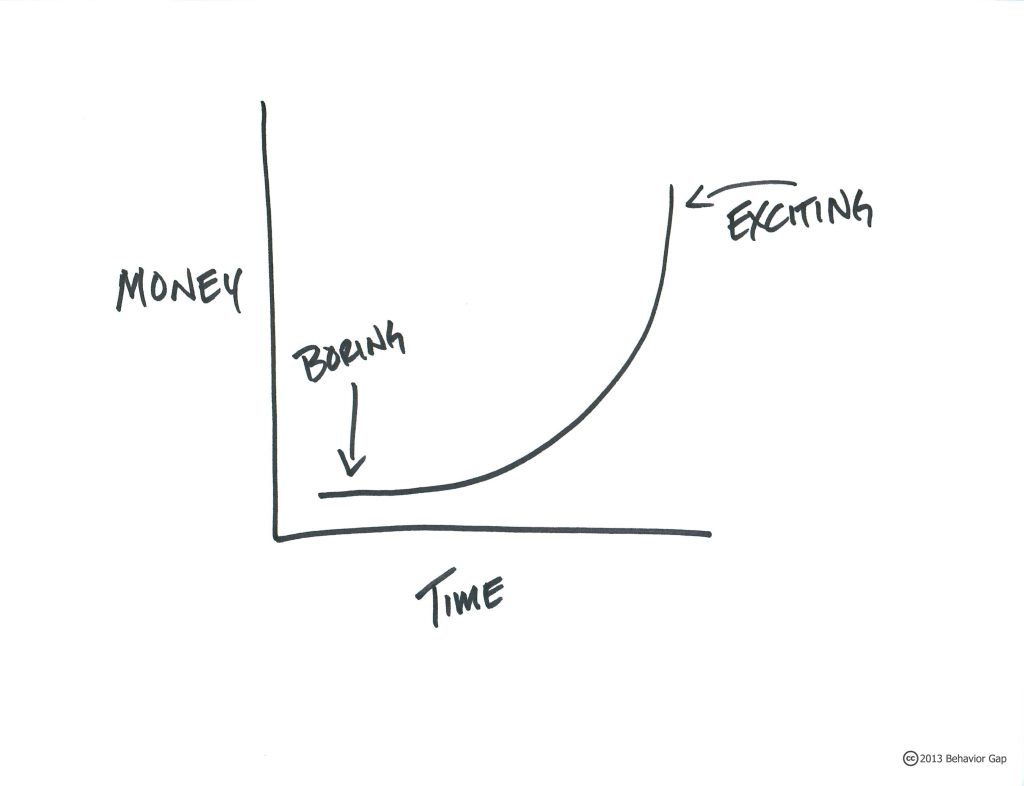

How to Build It: It’s OK to begin small if all these are too huge to handle at a go. Out of your checking account, you can automate transfers to the emergency fund every month. The drop in the bucket mentality of approaching is the best idea because the little contributions make a difference in the long run.

If something out of the ordinary happens, it offers a safety net through which people can meet expenses and still go forward and begin saving for the next eventuality.

4. Manage Debt Wisely

Another major issue that single parents experience relate to debt management. People face various types of debt and for any of them – credit card debt, student loans, mortgage – one ought to have a strategy on how to handle and eventually, repay the debt.

Prioritize High-Interest Debt: Budgeting involves a strategy of paying off certain types of debts, for instance credit cards, before others. Incurring these balances means you will be paying for them, and the cost increases the longer you hold them.

Consider Debt Consolidation: Some of the possible actions include the following: If you have many high interest debts, it is advisable to combine them into a single debt with a lower interest rate. This can help to make your payments more feasible and also bring the total amount of interest that you have to pay.

Avoid Accumulating New Debt: Avoid borrowing, especially for things which are not necessary to have. Work and stay on your budget and make good use of credit cards.

When your debt is well managed you are left with much of your income to save and meet other financial objectives.

5. One thing a couple ought to look at seriously is planning for the education of your children.

Indeed, education is one of the largest costs parents are going to face and it is essential to begin the process now. If you’re a single parent, you might have to start saving for your children’s college education from scratch and, as such, extra vigilant.

Start Early: One of the facts that speak more for early savings towards education is that it helps the money to earn more due to time factor purchased. Nothing beats a accumulation of small amounts of efforts, time, cash or whatever as they can add up over time.

Consider a 529 Plan: A 529 college savings plan provides tax benefits and also lets the holder save for the costs related to education. It has the added advantage that contributions to it are made without incurring any taxes, and distributions made from it are also tax free, when the money is being used to pay for qualified educational expenses.

Look for Scholarships and Grants: Make your children to seek scholarships and grants for them. These could greatly help cut down the cost of education to an extent of reliving the financial pressure burdening your family.

Education planning is thus an investment on your children to enable them have the academic and carrier of their dreams.

6. How to Safeguard your Family through Insurance

Due to the above reasons it becomes very crucial for single parents to have insurance as part of personal financial planning. It enables you to have cover in case of changes in your life situation whereby you have children to take care of.

Life Insurance: Basing on life insurance, finances are taken care of for the children in case you meet an accident. Term life insurance is likely to be the cheapest way of insuring for single parents offering cover for a specified number of years, for instance, till the children are grown up.

Health Insurance: Medical insurance is crucial in ensuring that costs incurred in accessing the health facilities and or the treatment is managed. Make sure that you, and your children, are eligible for good medical insurance through your place of employment, state welfare provisions or private insurance.

Disability Insurance: Disability insurance protection pays out if the insured is unable to work because of sickness or accident. This coverage can be very useful to families which only have a single breadwinner particularly in the case of single parents.

Having the right insurance cover gives one a sense of security and protection of the family’s financial status.

7. Plan for Retirement

Though, dreaming about one’s retirement when you are in the middle of raising children may be rather difficult, still it is important to think about the future. Finally, there may be requirements to save for retirement , which may be quite important as a single parent to arrange for ones own living in future.

Contribute to Retirement Accounts: The concept of a 401(k) or an IRA is another option you must tap when planning for retirement. Save as much as one can allow to do and endeavor to maximize on any 401k employer matching or any other kind of match.

Automate Your Savings: Some of the positive changes that can be made include establishing that regular contributions to your retirement accounts should be automatic. This makes sure that in the middle of organizing for the current jobs, you are also giving a touch on retirement saving.

Don’t Rely Solely on Social Security: Again Social Security can offer some income in the retirement periods; however, it cannot be relied upon to cater for all one’s expenses. Nobody else should be responsible for saving for the requested retirement, it should be your responsibility.

Saving for retirement guarantee you will still be able to live the kind of life you want well into your sunset years.

8. Seek Professional Financial Advice

Being a single parent is already stressful and handling the finances can be even more stressful, but there is help. It is therefore advisable that an individual consult a financial planner or a financial advisor to assist him or her to overcome whatever circumstances he or she may be experiencing.

Financial Advisors: It is essential to note that you have to work with a specialized financial advisor to plan your financial strategy in a given plan. They can help you with your budgeting, investment, planning for retirement and many more.

Estate Planning: These include preparing for your will, making arrangements for the kids in case of your demise and creating trusts for your property among other services that an estate planning attorney offers.

It shows that to get such goal, one may seek professional advice for more strategies which he or she needs to take when getting to the goal.

Conclusion

Budgeting is the key process in ensuring that single parents and their families have financially secure future. Generally, if you evaluate your financial position, develop a budget, design an emergency fund, control credit cards, plan for the education of your children, obtain insurance, save for retirement, and consult professionals, you can will be in charge of your personal finance. It is a long and hard trip, but if you follow the rules and work hard you can predict your family’s financial future and make it a happy one.

FAQs on “The Ultimate Guide to Financial Planning for Single Parents”:

1. What is the first step in financial planning for single parents?

The first step is to assess your current financial situation. This involves listing all sources of income, regular expenses, debts, and assets. Understanding your starting point helps in setting realistic financial goals and creating a budget that works for your circumstances.

2. How can single parents create a realistic budget?

Start by tracking your spending over a month to understand where your money is going. Prioritize essential expenses like housing, food, and childcare. Allocate funds for savings and debt repayment, and plan for irregular expenses like medical bills or car repairs.

3. Why is an emergency fund important for single parents?

An emergency fund acts as a financial safety net, providing security in case of unexpected expenses such as medical emergencies, job loss, or urgent home repairs. Aim to save three to six months’ worth of living expenses in a readily accessible account.

4. How much should single parents save for an emergency fund?

Ideally, you should save three to six months’ worth of essential living expenses. This includes rent or mortgage, utilities, groceries, and any necessary monthly bills. Start with small, consistent contributions to build this fund over time.

5. What are some tips for managing debt as a single parent?

Prioritize paying off high-interest debt like credit cards first. Consider debt consolidation to lower interest rates and streamline payments. Avoid accumulating new debt and stick to a budget to manage existing debts effectively.

6. How can single parents save for their children’s education?

Start saving early, even if it’s a small amount. Consider using a 529 college savings plan, which offers tax advantages. Encourage your children to apply for scholarships and grants to reduce the need for loans.

7. What is a 529 plan, and how does it help with education savings?

A 529 plan is a tax-advantaged savings plan designed to encourage saving for future education costs. Contributions grow tax-free, and withdrawals for qualified education expenses are also tax-free, making it an effective tool for saving for your child’s education.

8. How can single parents protect their family with insurance?

Life insurance is crucial for ensuring your children are financially secure if something happens to you. Health insurance is essential for covering medical expenses, and disability insurance provides income if you are unable to work due to illness or injury.

9. What type of life insurance is best for single parents?

Term life insurance is often the most affordable and straightforward option for single parents. It provides coverage for a specific period, such as until your children are financially independent, and offers a larger benefit at a lower premium compared to whole life insurance.

10. How can single parents plan for retirement while managing other financial responsibilities?

Prioritize contributing to retirement accounts, such as a 401(k) or IRA, even if you can only contribute a small amount. Automate your savings to ensure consistency, and take advantage of employer matching contributions if available.

11. What are the tax benefits available to single parents?

Single parents may qualify for several tax benefits, including the Earned Income Tax Credit (EITC), Child Tax Credit, and Head of Household filing status, which can lower taxable income and increase potential refunds.

12. How can single parents balance saving for retirement and their children’s education?

It’s important to prioritize your retirement savings first, as there are more options for financing education, such as scholarships, grants, and loans. Contribute to retirement accounts consistently, and then allocate funds to a 529 plan or education savings account.

13. What estate planning steps should single parents take?

Single parents should create a will, designate a guardian for their children, and establish a trust to manage their assets. It’s also important to name beneficiaries for life insurance policies and retirement accounts.

14. How can single parents teach their children about money management?

Involve your children in budgeting, saving, and spending decisions. Use real-life situations to teach them the value of money, such as saving for a toy or contributing to household expenses. Encourage saving a portion of any money they receive.

15. What resources are available to help single parents with financial planning?

Consider consulting a financial advisor who specializes in working with single parents. Many non-profit organizations offer financial planning resources, and online budgeting tools can help you manage your finances effectively.

16. How can single parents increase their income?

Look for opportunities to increase your income through side hustles, part-time work, or asking for a raise. Consider furthering your education or gaining new skills to qualify for higher-paying jobs.

17. What should single parents consider when investing?

Start with a diversified portfolio that balances risk and return, considering your long-term goals and risk tolerance. Focus on low-cost index funds or mutual funds and consider working with a financial advisor to create a strategy that aligns with your needs.

18. How can single parents save on childcare costs?

Explore options like flexible spending accounts (FSAs) for dependent care, which offer tax savings. Look for community resources, family support, or government programs that provide childcare assistance. Consider sharing childcare responsibilities with other parents.

19. What are some ways single parents can reduce household expenses?

Cutting unnecessary expenses, such as dining out or subscription services, can free up money for savings or debt repayment. Shop for groceries with a list and take advantage of discounts and coupons. Energy-efficient practices can also reduce utility bills.

20. How can single parents plan for big expenses, such as buying a home or a car?

Save for big expenses by setting aside money each month in a dedicated savings account. Research financing options and consider buying used rather than new to reduce costs. Ensure that any large purchase fits within your overall financial plan.

21. What should single parents do if they face a financial emergency?

Having an emergency fund is crucial. If you don’t have one, consider liquidating non-essential assets, negotiating payment plans with creditors, or seeking assistance from community organizations. Avoid using high-interest credit options, such as payday loans.

22. How can single parents effectively manage time and finances?

Use budgeting apps or software to streamline your financial management. Set aside regular time each week to review your finances, pay bills, and plan for upcoming expenses. Automate savings and bill payments to reduce the time spent on these tasks.

23. What financial assistance programs are available for single parents?

Single parents may qualify for government assistance programs such as SNAP (Supplemental Nutrition Assistance Program), WIC (Women, Infants, and Children), and housing subsidies. These programs can help reduce financial strain and provide necessary support.

24. How can single parents protect their financial future?

Regularly review and update your financial plan as your situation changes. Ensure you have adequate insurance coverage, keep your emergency fund well-funded, and stay disciplined with your budget and savings goals.

25. What financial goals should single parents prioritize?

Prioritize building an emergency fund, paying off high-interest debt, saving for retirement, and ensuring your family is adequately insured. Education savings and other long-term goals should be planned once these foundational goals are in place.

Also visit:-