Table of Contents

Tips for Conducting a Financial SWOT Analysis | Rank up Revolution

1. Introduction: Tips for Conducting a Financial SWOT Analysis

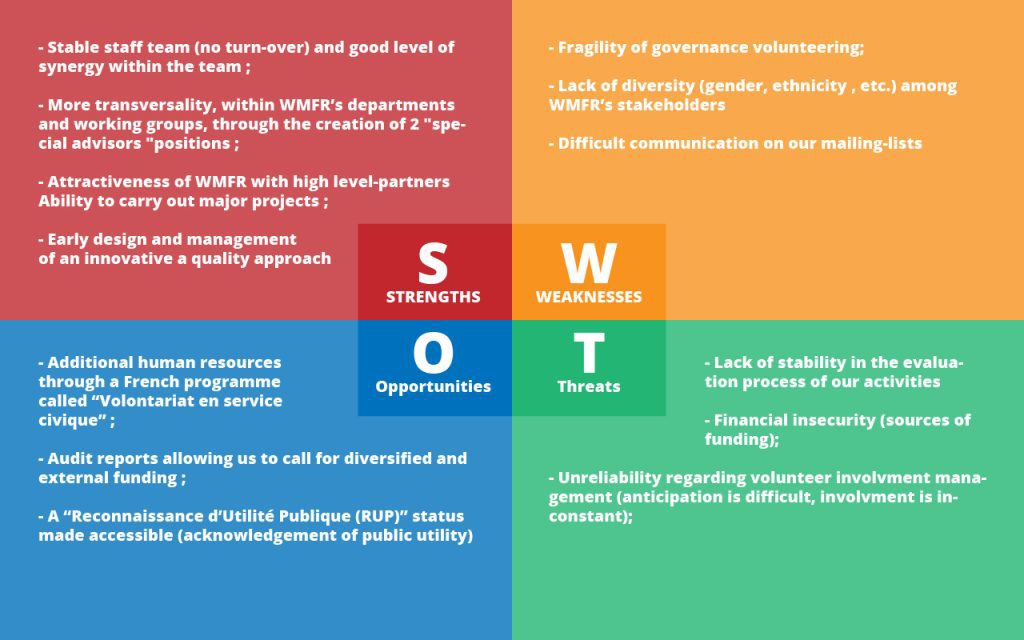

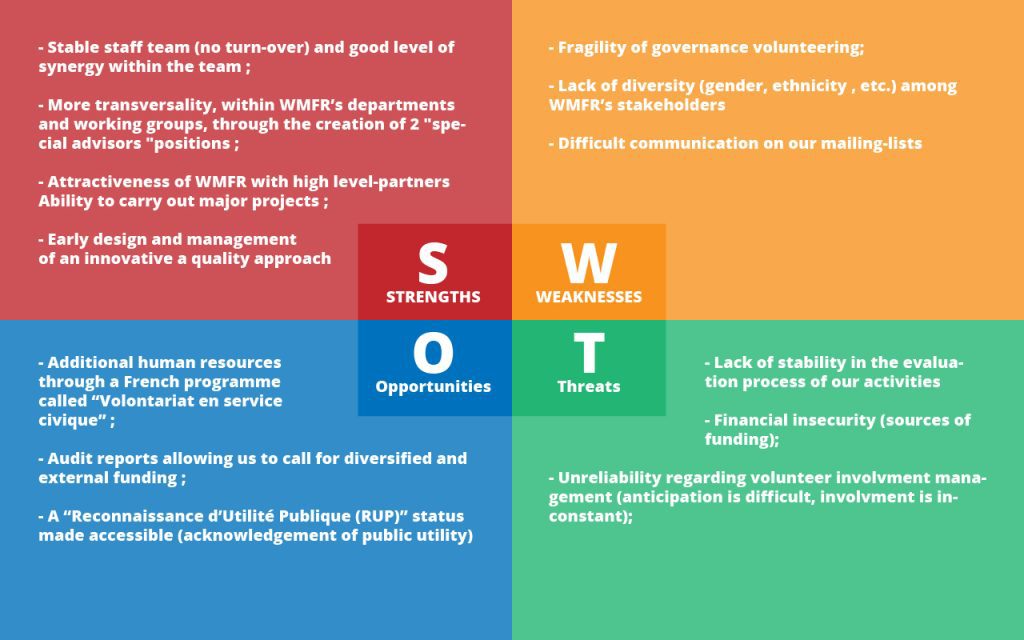

Tips for Conducting a Financial SWOT Analysis: Conducting a financial SWOT analysis, which examines Strengths, Weaknesses, Opportunities, and Threats from a financial standpoint, can transform how individuals or businesses see their financial trajectory. It serves as a strategic compass—helping pinpoint where you’re excelling, where you’re vulnerable, where to grow, and what to guard against.

In this richly detailed, 3,000‑plus‑word guide, you’ll find practical, human‑tone advice that feels like a strategy talk with a trusted advisor. We’ll go beyond jargony definitions and dive into actionable tips that make your financial SWOT smart, structured, and supremely useful.

2. Why a Financial SWOT Matters

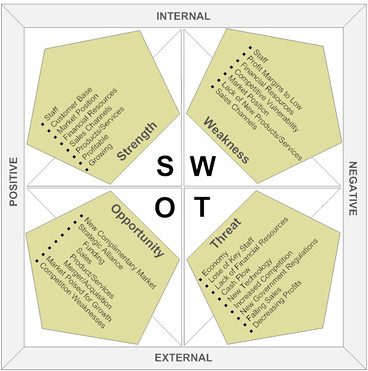

A regular SWOT might focus broadly on brand, marketing, team, or operational strengths and weaknesses. When you narrow the lens to the financial dimension, you expose insights that truly power decision‑making:

- Clarity: You highlight your most robust financial metrics and your vulnerabilities in stark relief.

- Strategy alignment: It helps align financial realities with business or personal goals, ensuring strategies are realistic.

- Risk mitigation: When threats like rising costs or cash‑flow crunches are clearly defined, you can plan preemptively.

- Growth focus: Identifying opportunities grounded in financial data ensures you’re chasing goals you can afford to invest in.

For SEO, keywords like financial SWOT analysis tips, conducting financial SWOT, financial strengths and weaknesses, and SWOT financial planning are gold. We’ll sprinkle them naturally throughout.

3. Step 1: Clarify Purpose & Scope

Before diving in, get crystal clear:

- What is the goal? Is this personal finance, a startup’s runway analysis, a department’s budget review, or a corporation’s annual forecasting?

- Scope & timeframe: Are you covering past year‑end data only? Or forecasting over next 12 months, 3 years, or longer?

- Audience: Is this for internal leadership, external investors, lenders, or just your own clarity?

Tip: Frame your analysis in one or two short sentences. Example:

“The purpose of this financial SWOT is to assess the company’s liquidity and profitability from Q1 to Q3 FY 2025, to guide investment and cost‑management decisions.”

This clarity shapes how you gather data and what counts as a strength vs. an opportunity.

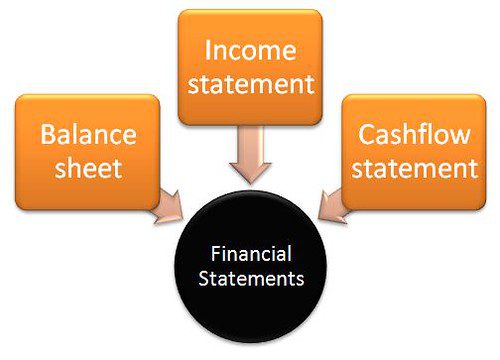

4. Step 2: Gather Financial Data

No guesswork—only real numbers. Collect:

- Income statements (Profit & Loss): revenue trends, gross and net margin changes.

- Balance sheets: assets, liabilities, equity dynamics.

- Cash‑flow statements: operating, investing, financing inflows/outflows.

- KPIs: maybe debt‑to‑equity, current ratio, quick ratio, return on assets, etc.

- Budget vs. actuals: variances can be revealing.

- Historical trends: 3–5 years gives context.

Human-centered advice: make sure your data is clean, consistent, and timely. Invest time in verifying numbers—analyses built on shaky data are quickly worthless.

Pro tip: Organize everything in a spreadsheet with clear labels. This helps when you revisit or expand the SWOT later.

5. Step 3: Identify Strengths

Think: where is your financial house in solid shape?

- Strong liquidity: High current or quick ratios, positive working capital.

- Healthy profitability: High gross, operating, or net margins.

- Low debt burden: Manageable or declining debt levels, favorable interest ratios.

- Cash reserves: Cushion to weather downturns or seize opportunities.

- Revenue growth: Consistent upward trends, diversification across products or clients.

- Efficient operations: Low burn rate, improving cost-to-revenue ratios.

How to Describe Strengths Well

- Be specific: “Current ratio of 2.5× vs. industry average of 1.5×.”

- Add context: “Margin improved from 5% to 8% over two years due to cost controls.”

- Highlight stability: “Cash reserves cover 6 months of operating expense.”

6. Step 4: Assess Weaknesses

No shame—weaknesses are what set the stage for improvement.

Look for:

- Negative or thin cash flow: Frequent dips into overdrafts or extended payables.

- Declining margins: Rising costs, pricing pressures.

- High debt: Debt maturing soon, high interest servicing costs.

- Revenue concentration: Over-reliance on one major customer or product.

- Capital inefficiency: Inventory pile-up, poor asset utilization.

- Unexpected variances: Budget overspends, missed projections.

Make Weaknesses Meaningful

Phrase them compassionately:

“Cash-flow is unpredictable, with a shortfall of up to $50K in two of past six months.”

This keeps tone constructive, avoids blame, and paves the way for strategy.

7. Step 5: Spot Opportunities

Growth doesn’t come from staring at weakness—it comes from looking forward.

Identify:

- New revenue streams: Adjacent services, new geographies, niche markets.

- Financing possibilities: Low-interest loans, grants, equity rounds, partnerships.

- Cost-saving innovations: Automation, renegotiating supplier rates, process improvements.

- Market conditions: Rising demand, lower competition, favorable regulations.

- Asset leverage: Idle equipment, excess real estate, unused credit lines.

How to Frame Opportunities

Be bold but grounded:

“Expanding into Region X could boost revenue by an estimated 20% over 18 months, based on comparable firm entry metrics.”

Include rationale, not just wishful thinking.

8. Step 6: Evaluate Threats

These are the external or endogenous risks lurking:

- Economic headwinds: Inflation ramp-up, interest hikes, recession signals.

- Competitive pressure: New entrants, pricing wars, tech disruption.

- Regulatory changes: Tax reform, licensing costs, compliance burdens.

- Funding constraints: Investor reticence, credit tightening, covenant risks.

- Dependency vulnerabilities: Key supplier or customer instability.

Present Threats Sensibly

Use measurable terms:

“Rising benchmark interest rate projected to increase borrowing cost by 1.5%, raising annual interest expense by ~$30K.”

This signals urgency without panic.

9. Step 7: Prioritize & Analyze Findings

A laundry list won’t move the needle. Instead:

- Rank items by impact and probability:

- High impact / high probability: Top priority.

- Low impact / low probability: Secondary.

- Cross‑map: Link weaknesses to threats. Weakness + threat may equal crisis.

- Map strengths to opportunities: That’s where your strategic sweet spot is.

Example Table (brief):

| Quadrant | Financial Area | Example Item | Priority |

|---|---|---|---|

| Strength | Liquidity | Strong cash reserves | Medium |

| Weakness | Debt Structure | High short-term debt maturing | High (threat synergy) |

| Opportunity | New Market Entry | Launch product line in Region X | High |

| Threat | Interest Rates Increase | Forecasted rise impacting debt servicing | High |

10. Step 8: Develop Actionable Strategies

Now, turn insight into action:

- Strategies to defend strengths: e.g., keep cash reserves steady, maintain customer diversification.

- Strategies to shore up weaknesses: restructure debt, improve collections, renegotiate terms.

- Strategies to seize opportunities: prepare entry plans, allocate pilot capital, test market.

- Strategies to mitigate threats: hedge interest, diversify suppliers, build contingency reserves.

Be SMART:

- Specific: What exactly will you do.

- Measurable: How much, when.

- Achievable: Realistic given your resources.

- Relevant: Aligned with objectives.

- Time‑bound: With deadlines.

Example:

“Secure a 5‑year fixed‑rate loan of $200K at ≤6% interest by Q4 2025 to refinance current short‑term debt and improve interest coverage.”

11. Step 9: Monitor & Update

Financial SWOT isn’t a one-off:

- Set review cadence: monthly for tactical details, quarterly for strategic shifts, annual for big-picture reset.

- Track progress: create dashboard for key measures tied to SWOT (e.g. current ratio, debt servicing coverage, revenue growth).

- Revisit assumptions: If interest forecasts change or margins shift, your SWOT needs refresh.

Keep a “SWOT Journal”: record dates, adjusted items, new insights. This builds institutional knowledge.

12. Common Pitfalls & How to Avoid Them

- Vague statements: Avoid “we have low margins”—tie numbers: “margins dropped to 4% vs. target 8%.”

- Wishful optimism: Don’t pencil in opportunities without backing data.

- Overlooking external factors: SWOT is both internal and external.

- Neglecting follow-up: Analysis with no action is just reporting.

- Ignoring stakeholders: Engage leadership or finance partners for richer insight and buy-in.

- One-time exercise: Treating it as annual checkbox undermines its power.

13. Tips to Make Your Financial SWOT Shine

- Humanize insights: “While cash‑flow has been tight, improving receivables reserve gives us runway.”

- Use storytelling: Begin with a short anecdote: “Last summer, when our top client paused purchases, our cash‑reserves buffer kept us operating. That moment became a keystone in our SWOT—highlighting liquidity as a strength, but also reliance on a single client as a weakness.”

- Visualize where helpful: simple charts—trend lines, bar comparisons, ratio plots.

- Tie SWOT to goals: connect analysis to strategic roadmap or personal objectives.

- Cross‑functional input: finance, operations, sales—each can offer nuance.

- SEO key phrases (naturally):

- Tips for conducting a financial SWOT analysis

- Financial SWOT analysis guide

- How to do a financial SWOT

- Business financial SWOT strengths, weaknesses, opportunities, threats

- Use subheadings and lists for readability—search engines and people love skimmable text.

14. Conclusion

A financial SWOT analysis, when done thoughtfully, offers transformative clarity. It reveals:

- Where you stand (strengths),

- What needs shoring (weaknesses),

- Where to grow (opportunities),

- What to watch (threats).

By following this structured, human‑tone playbook—from clarifying your purpose, gathering sharp data, analyzing each quadrant, prioritizing, taking SMART actions, to monitoring over time—you set yourself or your organization on a path of resilient, strategic financial management.

Remember: the real value lies not in the document, but in the decisions driven by it. Build it with care, revisit it with discipline, and let it guide you toward financial confidence and forward momentum.

🔎 Financial SWOT Analysis – Top FAQs

1. What is a financial SWOT analysis?

A financial SWOT analysis is a strategic planning tool used to evaluate a business’s or individual’s financial Strengths, Weaknesses, Opportunities, and Threats. It helps identify areas of stability, risk, and potential growth based on financial data.

2. Why is financial SWOT analysis important?

It provides clarity on financial health, supports data-driven decision-making, reveals growth opportunities, and helps mitigate risks. It’s essential for budgeting, investing, or preparing for major changes.

3. How do I start a financial SWOT analysis?

Begin by defining the goal and scope. Then gather financial data like income statements, cash flow reports, and balance sheets before identifying your financial strengths, weaknesses, opportunities, and threats.

4. Who should conduct a financial SWOT analysis?

Entrepreneurs, business owners, finance teams, investors, or even individuals managing personal finances can benefit from a financial SWOT analysis.

5. How often should a financial SWOT be done?

At minimum, once a year. However, it’s ideal to revisit it quarterly, or whenever there’s a major financial shift—like a funding round, expansion, or market disruption.

6. What’s the difference between a regular SWOT and a financial SWOT?

A general SWOT looks at business factors (like marketing or operations), while a financial SWOT focuses solely on the numbers—profitability, cash flow, debts, investments, etc.

7. What are examples of financial strengths?

High liquidity, growing revenue, strong cash reserves, low debt, and positive net profit margins.

8. What are examples of financial weaknesses?

Poor cash flow, high-interest debt, low profitability, inconsistent income, or budget overruns.

9. What qualifies as a financial opportunity?

Entering a new market, securing low-interest financing, cost-reduction strategies, or expanding product lines profitably.

10. What are examples of financial threats?

Inflation, rising interest rates, shrinking markets, competitive pricing pressure, or customer concentration risk.

11. Can startups use financial SWOT analysis?

Absolutely. It helps startups assess their runway, cost structure, early revenue models, and funding options.

12. Is a financial SWOT useful for personal finance?

Yes. It can help individuals identify spending patterns, manage debt, increase savings, and prepare for financial goals or risks.

13. What documents do I need for a financial SWOT?

Income statements, balance sheets, cash flow statements, budgets, forecasts, and key financial ratios.

14. How long does it take to complete a financial SWOT?

Depending on complexity, it may take a few hours to several days—especially when gathering and verifying financial data.

15. How do I measure financial strengths or weaknesses?

Use ratios like current ratio, quick ratio, net profit margin, debt-to-equity, and cash conversion cycle for objective insight.

16. What tools can I use for financial SWOT analysis?

Spreadsheets, accounting software (like QuickBooks), financial dashboards, or strategic planning templates.

17. What’s the biggest mistake people make in a financial SWOT?

Being too vague or failing to back up observations with real data. Subjective insights won’t lead to smart financial decisions.

18. Can a financial SWOT predict bankruptcy?

It can highlight warning signs—like negative cash flow, unsustainable debt, or shrinking margins—that may signal financial distress.

19. How do I turn a SWOT analysis into action?

Create SMART goals from your findings. For example, if “high short-term debt” is a weakness, your action might be: “Refinance $100K debt to long-term loan by Q4.”

20. Should a financial SWOT include external market factors?

Yes. While strengths and weaknesses are internal, opportunities and threats should consider external economic and industry trends.

21. Is financial SWOT useful for nonprofits?

Definitely. It helps nonprofits manage donor dependency, assess cost-efficiency, and plan sustainable budgeting strategies.

22. How do I validate the findings of a financial SWOT?

Use benchmarks, industry standards, or third-party audits to confirm your strengths and identify overlooked risks.

23. Should I involve my team in a financial SWOT?

Yes. Collaboration brings in diverse perspectives—finance, operations, sales—that can uncover blind spots and generate smarter ideas.

24. How do I prioritize items in the SWOT matrix?

Rate each on impact and likelihood. Address high-impact/high-probability issues first for maximum effect.

25. Can I use AI tools for financial SWOT analysis?

Yes, AI-powered platforms can help analyze data trends, forecast risks, and visualize patterns—but human judgment is still key.

26. What if I can’t identify any opportunities?

Look closer. Even in downturns, there are opportunities—such as cutting unnecessary costs, negotiating better supplier terms, or reallocating capital.

27. Can I use financial SWOT in a business plan?

Absolutely. Investors and lenders value a realistic, data-driven SWOT that shows awareness and readiness.

28. How detailed should my financial SWOT be?

Detailed enough to drive decisions, but not so overwhelming that it becomes unreadable. Focus on clarity, impact, and next steps.

29. What KPIs are useful in a financial SWOT?

Revenue growth rate, gross margin, operating margin, EBITDA, current ratio, debt-to-equity, and net cash flow.

30. How can I present a financial SWOT to stakeholders?

Use visuals like charts, highlight key insights in bold, and keep the tone strategic—not overly technical. Include recommendations.

31. How does a financial SWOT support budgeting?

It identifies where to allocate or cut spending based on financial strengths and weaknesses—leading to smarter, aligned budgets.

32. What’s the difference between threats and weaknesses?

Weaknesses are internal financial issues (e.g. high overhead costs). Threats come from outside (e.g. economic downturn, tax hikes).

33. Can financial SWOT improve investor confidence?

Yes. A transparent, well-done SWOT signals competence, awareness, and proactive risk management—traits investors love.

34. Should I document assumptions in my SWOT?

Always. Assumptions (like future interest rates or market growth) affect your analysis and should be clearly stated.

35. Can financial SWOT help with crisis planning?

Yes. It helps preempt potential crises by highlighting threats and weaknesses early, giving you time to build contingency plans.

Also visit:-