Table of Contents

How to Read and Understand Financial Statements

How to Read and Understand Financial Statements: Financial statements are often seen as complicated documents reserved for accountants and financial experts. However, the truth is that anyone with the right guidance can learn how to read and understand them. Whether you are a small business owner, an investor, or simply someone interested in personal finance, knowing how to interpret financial statements can unlock valuable insights into how money flows in and out of a business.

Financial statements tell a story. They describe how a company earns its money, how it spends it, what it owns, what it owes, and how healthy it is financially. When you learn how to read these reports, you can identify trends, evaluate performance, and make better decisions for yourself or your business. In this article, we will break down the three core financial statements—Income Statement, Balance Sheet, and Cash Flow Statement—while also exploring how to interpret the numbers and what they really mean.

Why Financial Statements Matter

Financial statements are the backbone of business reporting. Every company, from small local shops to global corporations, must prepare them to provide transparency and accountability. They are used by investors to determine whether a company is worth investing in, by lenders to decide whether to extend credit, by regulators to ensure compliance, and by business owners to make smarter operational decisions.

Without financial statements, it would be impossible to measure the progress of a company or compare it to others. They create a common language of numbers, making it possible to evaluate success, spot weaknesses, and set future goals.

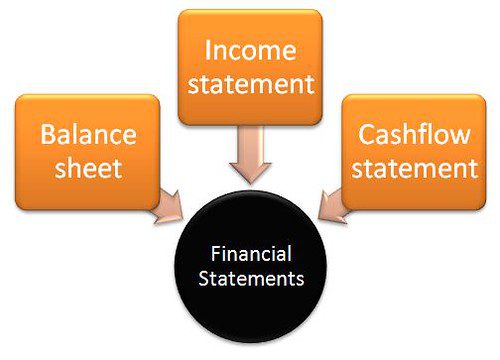

The Big Three Financial Statements

Although there are many reports businesses can prepare, three major financial statements are universally recognized: the Income Statement, the Balance Sheet, and the Cash Flow Statement. Together, these three documents provide a complete picture of a company’s financial health.

Understanding the Income Statement

The Income Statement, often called the Profit and Loss Statement, shows how much money a company earned and spent over a period of time. It summarizes revenues, expenses, and profits, giving a clear picture of whether the company made money or lost money.

At the top, you’ll find revenue or sales, which represent the total amount of money earned from products or services. Then you’ll see the costs associated with delivering those products or services, often called the cost of goods sold. Subtracting this cost from revenue gives you the gross profit.

The statement then moves on to operating expenses such as salaries, marketing, rent, and utilities. After subtracting these expenses, you get operating income, which reflects how profitable the company is from its core business activities.

Finally, the income statement includes other income and expenses, such as interest earned, taxes paid, or one-time gains and losses. The bottom line is the net income, often referred to simply as profit. This figure tells you how much money the company actually kept after paying all expenses.

Learning how to read an income statement allows you to understand the profitability of a company. It also helps identify trends, such as whether sales are growing, expenses are rising, or profit margins are shrinking.

Understanding the Balance Sheet

The Balance Sheet is a snapshot of a company’s financial position at a specific point in time. Unlike the income statement, which covers a time period, the balance sheet shows what the company owns and owes on a particular date.

On one side of the balance sheet are assets, which include everything the company owns. Assets can be current, such as cash and accounts receivable, or long-term, such as buildings, equipment, and investments.

On the other side are liabilities and equity. Liabilities represent everything the company owes, such as loans, accounts payable, or other obligations. Equity represents the ownership interest in the company, including money invested by shareholders and retained earnings.

The balance sheet follows a simple formula:

Assets = Liabilities + Equity

This equation must always balance. If a company has more assets than liabilities, it is generally in a stronger position. However, if liabilities outweigh assets, it could indicate financial stress.

By examining a balance sheet, you can see whether a company has enough liquidity to pay its short-term obligations, how much debt it carries, and how effectively it uses its resources.

Understanding the Cash Flow Statement

The Cash Flow Statement explains how cash moves in and out of a business. Even profitable companies can run into trouble if they do not manage their cash properly. This statement breaks down cash activity into three main categories: operating activities, investing activities, and financing activities.

Operating activities reflect the cash generated from the core business operations. This includes revenue received from customers, cash paid to suppliers, and salaries paid to employees. If a company consistently generates positive operating cash flow, it suggests that the business is strong and sustainable.

Investing activities show how much money is being spent on long-term assets, such as buying equipment, buildings, or securities. Although spending in this category may reduce short-term cash, it often reflects long-term growth plans.

Financing activities involve borrowing money, repaying loans, or issuing shares. These activities reflect how a company funds its operations and growth. For example, a company might issue new stock to raise capital or take out a loan to expand.

The net result of the cash flow statement shows whether a company’s cash balance increased or decreased during the period. This statement is crucial because a company can report profits on its income statement while still struggling with cash shortages.

How to Interpret Financial Statements Together

While each statement provides valuable insights, the real power comes from analyzing them together. The income statement may show profitability, but the cash flow statement can reveal whether that profit is actually turning into cash. The balance sheet shows what a company owns and owes, which can explain why profits may or may not translate into stability.

For example, a company could report a high net income but also show increasing debt on the balance sheet and negative cash flow. This might signal financial trouble despite apparent profitability. On the other hand, a company with modest income but strong cash flow and manageable liabilities may be in better financial shape.

Reading financial statements together helps you see the complete story. They are not isolated documents but pieces of a puzzle that provide insights into performance, liquidity, stability, and future potential.

Key Ratios That Bring Financial Statements to Life

Financial statements are filled with raw numbers, but ratios make them easier to interpret. Ratios provide quick indicators of financial health and performance. For instance, profitability ratios show how much profit a company makes relative to its sales, liquidity ratios show whether a company can meet short-term obligations, and leverage ratios reveal how much debt the company is using.

These ratios are derived by combining figures from different financial statements. For example, the current ratio compares current assets from the balance sheet with current liabilities, giving insight into liquidity. Return on equity compares net income from the income statement with equity from the balance sheet, showing how effectively shareholder money is being used.

Ratios simplify complex financial information and allow comparisons across companies, industries, and time periods.

Common Mistakes to Avoid When Reading Financial Statements

Many beginners make the mistake of looking only at the net income figure or focusing on one statement in isolation. This can be misleading because profitability does not always equal financial health. A company might be profitable on paper but drowning in debt or suffering from cash shortages.

Another common mistake is ignoring trends. One year’s financials may not reveal much, but comparing several years shows growth, consistency, or decline. A company with stable revenue and gradually improving margins may be a safer bet than one with dramatic ups and downs.

It’s also important to remember that accounting choices can affect how statements look. For example, the way depreciation or inventory is recorded can impact profits and assets. Understanding these practices helps you interpret the numbers more accurately.

Why Understanding Financial Statements Matters for Everyone

Reading financial statements is not just for accountants or investors. Entrepreneurs need them to track performance and secure funding. Employees can use them to evaluate the stability of their company. Individual investors can analyze them before buying stocks. Even in personal finance, the principles of income, assets, liabilities, and cash flow apply.

By learning how to read financial statements, you gain the ability to make informed decisions. You can identify risks, spot opportunities, and build a deeper understanding of how businesses function. This knowledge empowers you to protect your money, grow your wealth, and contribute to smarter financial discussions.

Building Confidence in Financial Analysis

At first glance, financial statements may seem intimidating, filled with terms and numbers that feel overwhelming. But with practice, they become more familiar and easier to navigate. Start by focusing on the basics—revenue, expenses, assets, liabilities, and cash flow. Then gradually build your understanding of more advanced concepts, such as ratios and accounting principles.

Over time, you will begin to see patterns and relationships between the numbers. The story they tell will become clearer, and your confidence in making financial judgments will grow. Like any skill, practice is key. The more you analyze financial statements, the more fluent you become in the language of business.

Final Thoughts

Financial statements are powerful tools that unlock the inner workings of a business. By understanding the income statement, balance sheet, and cash flow statement, you can gain insights into profitability, stability, and sustainability. Reading them together reveals the bigger picture, while ratios and trends provide deeper analysis.

The ability to interpret financial statements is not limited to financial professionals. It is a valuable skill for anyone who wants to make smarter financial decisions. Whether you are investing, running a business, or simply managing your personal finances, learning this skill gives you an edge.

At its core, understanding financial statements is about more than just numbers. It’s about learning to see the story behind the numbers—the story of growth, challenges, opportunities, and potential. Once you master this, you can make decisions with confidence and clarity, turning information into action and action into results.

FAQs on How to Read and Understand Financial Statements

Q1: What are financial statements?

Financial statements are official records that summarize the financial activities and position of a business. They typically include the income statement, balance sheet, and cash flow statement.

Q2: Why are financial statements important?

They provide insights into a company’s profitability, stability, and cash flow, helping investors, lenders, and business owners make informed decisions.

Q3: What is the income statement?

The income statement shows a company’s revenues, expenses, and profits over a specific period, revealing whether it earned or lost money.

Q4: What is the balance sheet?

The balance sheet provides a snapshot of what a company owns (assets), what it owes (liabilities), and the value belonging to owners (equity) at a specific point in time.

Q5: What is the cash flow statement?

The cash flow statement tracks how cash moves in and out of a business, highlighting operating, investing, and financing activities.

Q6: How do income statements and balance sheets differ?

The income statement covers performance over time, while the balance sheet shows financial position at a specific date.

Q7: How do cash flow statements help businesses?

They help businesses monitor liquidity, ensuring they have enough cash to cover operations, debts, and growth activities.

Q8: Who uses financial statements?

They are used by business owners, managers, investors, creditors, regulators, and even employees to evaluate a company’s financial health.

Q9: How often are financial statements prepared?

Most businesses prepare them quarterly and annually, though some may prepare them monthly for internal use.

Q10: What is revenue in an income statement?

Revenue, or sales, is the total money earned from selling products or services before expenses are deducted.

Q11: What is net income?

Net income, often called profit, is the money left after all expenses, taxes, and interest are deducted from revenue.

Q12: Why is the balance sheet called a “snapshot”?

Because it shows a company’s financial position at one specific moment in time, not over a period.

Q13: What are assets in a balance sheet?

Assets are everything a company owns, such as cash, accounts receivable, inventory, property, or investments.

Q14: What are liabilities in a balance sheet?

Liabilities are what a company owes to others, such as loans, accounts payable, or other obligations.

Q15: What is equity in a balance sheet?

Equity represents ownership in the company, including shareholder investments and retained earnings.

Q16: How do assets and liabilities relate?

They are connected by the equation: Assets = Liabilities + Equity. This balance ensures the statement remains accurate.

Q17: What does positive cash flow mean?

Positive cash flow means more money is coming in than going out, which supports growth and stability.

Q18: Can a company be profitable but have negative cash flow?

Yes, a business may show profits on its income statement while facing cash shortages if expenses or debt payments are poorly managed.

Q19: Why is cash flow more important than profit sometimes?

Because cash flow reflects actual liquidity, showing whether a company can pay bills and survive day-to-day operations.

Q20: How do investors use financial statements?

They use them to evaluate profitability, risk, growth potential, and overall financial health before investing.

Q21: How do lenders use financial statements?

Banks and creditors assess financial statements to decide if a company can repay loans and manage debt.

Q22: What are current assets?

Current assets are short-term resources like cash, receivables, and inventory that can be converted into cash within a year.

Q23: What are current liabilities?

Current liabilities are obligations a company must pay within a year, such as short-term loans and accounts payable.

Q24: What is retained earnings?

Retained earnings are profits that a company keeps rather than distributing to shareholders as dividends.

Q25: What is depreciation in financial statements?

Depreciation is the gradual reduction in value of long-term assets, such as buildings and equipment, recorded as an expense.

Q26: Why do companies prepare quarterly reports?

Quarterly reports provide regular updates on performance, allowing stakeholders to monitor progress throughout the year.

Q27: What is an annual report?

An annual report is a comprehensive document summarizing a company’s yearly performance, including financial statements and management commentary.

Q28: What is gross profit?

Gross profit is the difference between revenue and the cost of goods sold, showing how efficiently products or services are delivered.

Q29: What is operating income?

Operating income reflects profit from a company’s main activities before interest and taxes are considered.

Q30: What are long-term liabilities?

Long-term liabilities are debts or obligations due after one year, such as bonds or long-term loans.

Q31: What is working capital?

Working capital is the difference between current assets and current liabilities, showing short-term financial health.

Q32: How can financial statements reveal growth potential?

By analyzing revenue trends, profit margins, and reinvestment in assets, you can assess whether a company is positioned for expansion.

Q33: Why do investors compare financial statements over several years?

Comparing across years helps identify patterns, growth trends, and risks that one year alone may not reveal.

Q34: What is liquidity in financial terms?

Liquidity refers to how easily a company can convert assets into cash to meet short-term obligations.

Q35: What is solvency?

Solvency is a company’s ability to meet long-term obligations, reflecting overall financial stability.

Q36: Why should beginners learn financial statements?

Understanding financial statements empowers beginners to make smarter investment, business, and personal finance decisions.

Q37: Can small business owners benefit from financial statements?

Yes, they help small business owners track performance, control costs, and secure funding.

Q38: Do financial statements follow rules?

Yes, they are prepared under accounting standards such as GAAP or IFRS to ensure consistency and transparency.

Q39: What is a consolidated financial statement?

It combines the financials of a parent company with its subsidiaries, giving a complete picture of the group’s performance.

Q40: How can I get better at reading financial statements?

Start by focusing on the basics—revenue, expenses, assets, liabilities, and cash flow—then practice regularly and compare across periods.

Also visit:-