Table of Contents

How to Balance Saving and Spending for Lifestyle

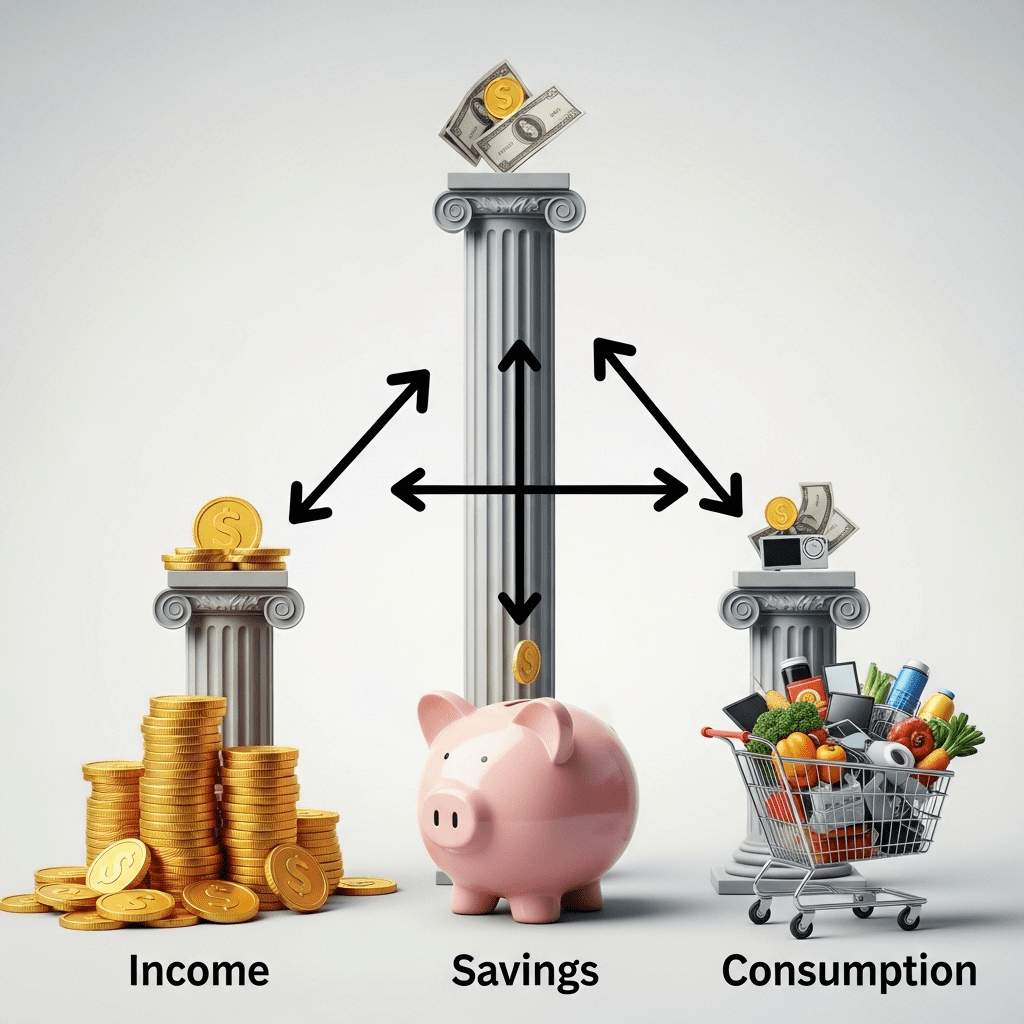

How to Balance Saving and Spending for Lifestyle: Finding the right balance between saving money and spending on the lifestyle you want can feel like walking a tightrope. On one side, you know saving is essential for your financial future—covering emergencies, long-term goals, and retirement. On the other side, life is meant to be enjoyed, and spending money on experiences, hobbies, or comforts is part of living well. The challenge is striking a balance where you can secure tomorrow without sacrificing today.

Many people struggle with this. Some save excessively, depriving themselves of meaningful experiences, while others overspend, leaving little room for financial growth. Neither extreme creates long-term satisfaction. The key lies in finding harmony—where you manage money responsibly while still enjoying the fruits of your hard work.

This guide explores how to balance saving and spending without guilt, stress, or unnecessary sacrifice.

Why Balance Matters

Balancing saving and spending isn’t just about numbers on a spreadsheet; it’s about creating a healthy financial lifestyle. Too much emphasis on saving can make life feel restrictive, while too much spending can lead to debt and financial insecurity. Both extremes lead to stress, but balance brings:

- Peace of mind: You know your financial future is secure.

- Freedom: You can say yes to opportunities without constant worry.

- Sustainability: A balanced approach is easier to maintain long-term.

- Fulfillment: You get to enjoy your money now while also preparing for tomorrow.

In other words, balance ensures money becomes a tool for living—not a source of constant anxiety.

Step 1: Understand Your Financial Priorities

Before you can balance saving and spending, you need clarity about what truly matters to you. Everyone’s financial priorities are different.

For example:

- If travel is a priority, you’ll want to set aside funds for vacations.

- If homeownership matters more, your savings will lean toward a down payment.

- If financial security brings you peace, you’ll save more aggressively for retirement.

Ask yourself:

- What do I value most in my lifestyle right now?

- What long-term goals are non-negotiable?

- Which expenses bring genuine happiness, and which are just habits?

Once you know your priorities, balancing becomes less about sacrifice and more about aligning money with your values.

Step 2: Create a Spending-Saving Framework

A proven way to balance lifestyle spending and financial responsibility is to use frameworks. These aren’t rigid rules, but they provide structure.

The 50/30/20 Rule

This popular method allocates:

- 50% of income to needs (housing, bills, groceries)

- 30% of income to wants (lifestyle, dining, entertainment)

- 20% of income to savings and debt repayment

This framework ensures you’re consistently saving while still enjoying life.

The Reverse Budget

Instead of planning expenses first, the reverse budget has you:

- Automatically save a set percentage of your income.

- Use the remaining money freely for expenses and lifestyle.

It works well if you prefer simplicity and don’t want to micromanage every dollar.

The Bucket System

Divide your money into separate “buckets” like essentials, lifestyle, travel, investments, and savings. Physically separating funds (using bank accounts or digital tools) prevents overspending and keeps balance visible.

Step 3: Automate Your Savings

One of the easiest ways to maintain balance is automation. When savings are automatic, you’re less likely to overspend.

Set up:

- Automatic transfers to a savings or investment account right after payday.

- Direct deposits into different accounts for lifestyle goals (like vacations or hobbies).

Automation ensures saving happens first, leaving you free to spend the rest without guilt.

Step 4: Avoid the Extremes

Finding balance means avoiding the trap of going “all in” on either saving or spending.

- Extreme savers: Constantly restrict themselves, miss out on experiences, and often end up resenting their financial life.

- Extreme spenders: Chase instant gratification, struggle with debt, and live with ongoing financial stress.

Instead, aim for flexibility. Allow yourself indulgences but keep future goals intact. For example, if you overspend one month, scale back slightly the next rather than abandoning your plan altogether.

Step 5: Build Lifestyle Spending into Your Plan

Many people think budgets mean restrictions, but a sustainable plan must include lifestyle expenses. Fun, leisure, and comfort aren’t luxuries—they’re part of a balanced life.

Examples of lifestyle categories to include:

- Dining out or coffee shop visits

- Hobbies and personal interests

- Vacations and travel

- Entertainment (movies, concerts, streaming)

- Self-care (gym, wellness, spa)

By planning for them, you avoid guilt and overspending while still enjoying life.

Step 6: Practice Conscious Spending

Conscious spending means being intentional about where your money goes. Instead of cutting back across the board, you prioritize what truly matters.

Steps to practice conscious spending:

- Track your spending for a month to see where money flows.

- Identify what brings joy—keep or increase spending here.

- Cut out what doesn’t matter—eliminate mindless purchases.

For instance, if travel excites you but takeout doesn’t, redirect your dining-out budget toward your next vacation.

Step 7: Plan for Big Expenses in Advance

Big lifestyle expenses—like vacations, weddings, or buying new gadgets—can throw your balance off if unplanned. Instead of using credit cards at the last minute, create sinking funds.

A sinking fund is a separate savings pot you contribute to regularly for a specific goal. When the expense comes, you can spend guilt-free because you planned ahead.

Step 8: Embrace Flexibility

Life is unpredictable. Income changes, emergencies happen, and new opportunities arise. A balanced financial plan adapts.

- If you get a raise, increase savings but also allow some lifestyle upgrades.

- If times are tough, focus more on essentials and savings until stability returns.

Balance doesn’t mean perfection every month—it means long-term stability over time.

Step 9: Use Tools to Stay on Track

Technology makes balancing saving and spending much easier. Apps and tools can track, remind, and guide your money habits.

Popular tools include:

- Mint: Tracks spending and sets goals.

- YNAB (You Need a Budget): Helps assign every dollar to a purpose.

- Personal Capital: Great for balancing saving, investing, and spending.

These tools give real-time insight into whether you’re leaning too heavily toward saving or spending.

Step 10: Balance Present Joy with Future Security

The ultimate goal is to live well today while building security for tomorrow. A sustainable approach doesn’t sacrifice one for the other.

Some tips for maintaining this balance:

- Treat saving as self-care for your future self.

- Treat spending as life enjoyment, not guilt.

- Regularly check in with your values—are you spending in line with them?

- Celebrate progress—acknowledge milestones in both saving and lifestyle goals.

Common Mistakes to Avoid

- All-or-nothing mindset – Thinking you must choose saving or spending.

- Lifestyle creep – Increasing spending every time your income rises instead of boosting savings.

- Ignoring lifestyle needs – Cutting all fun leads to burnout and resentment.

- Not planning for irregular expenses – Annual bills, birthdays, or vacations should be built in.

- Comparing to others – Your balance is unique; don’t let social media dictate your lifestyle choices.

The Psychology of Balance

Money decisions are emotional as much as logical. Understanding your psychology helps:

- If you’re naturally a spender, automate savings so you don’t feel restricted.

- If you’re naturally a saver, allow guilt-free fun money to avoid burnout.

- Practice mindfulness—ask yourself, “Will this purchase add lasting value?”

Balancing saving and spending isn’t just financial math; it’s emotional alignment with your values.

Long-Term Benefits of Balance

When you find the right balance, you unlock:

- Financial stability: You’re prepared for emergencies and goals.

- Reduced stress: You know money is under control.

- Sustainable lifestyle: You avoid burnout from deprivation.

- Enjoyment of life: You experience the present fully.

- Confidence for the future: You build wealth while living richly.

This balance creates not just financial success but also life satisfaction.

Final Thoughts

Balancing saving and spending isn’t about sacrifice—it’s about alignment. When your money matches your values, you naturally create a sustainable plan that supports both your present lifestyle and your future dreams.

The truth is, you don’t have to choose between saving for tomorrow and enjoying today. With intention, structure, and flexibility, you can confidently do both.

Remember: Your money should work for you—not the other way around.

Also visit:-

10 Simple Ways to Bring Romance Back into Your Marriage

FAQs on How to Balance Saving and Spending for Lifestyle

1. What does it mean to balance saving and spending?

Balancing saving and spending means managing your money so that you prepare for future financial goals while still enjoying your current lifestyle.

2. Why is balancing saving and spending important?

It’s important because it prevents financial stress, helps you build long-term wealth, and allows you to enjoy life without guilt or deprivation.

3. How do I know if I’m saving too much?

If saving makes you feel restricted, stops you from enjoying meaningful experiences, or causes stress, you may be saving excessively.

4. How do I know if I’m spending too much?

If you’re struggling to save, living paycheck to paycheck, or accumulating debt, it’s a sign of overspending.

5. What is the 50/30/20 rule for saving and spending?

It’s a guideline where 50% of income goes to needs, 30% to wants, and 20% to savings or debt repayment.

6. How much of my income should I save each month?

A common goal is at least 20% of your income, but it depends on your lifestyle, goals, and current obligations.

7. Can I still enjoy life while saving money?

Yes! The goal is to include lifestyle expenses in your budget so you can enjoy the present without neglecting the future.

8. What expenses fall under lifestyle spending?

Lifestyle spending includes dining out, travel, entertainment, hobbies, shopping, and other non-essential but enjoyable expenses.

9. What’s the difference between a budget and a spending plan?

A budget is often rigid and restrictive, while a spending plan is more flexible and focuses on aligning money with your values.

10. How do I start creating a balance between saving and spending?

Start by tracking your income and expenses, setting financial goals, and using a framework like the 50/30/20 rule.

11. How do I balance saving for the future and enjoying the present?

By allocating money to both—save consistently for goals while intentionally setting aside funds for lifestyle activities.

12. Is it okay to spend money on wants if I’m saving too?

Yes, as long as your savings goals are on track, spending on wants is part of a balanced lifestyle.

13. What is lifestyle creep, and how does it affect balance?

Lifestyle creep happens when spending increases with income, often reducing savings. It disrupts balance and delays financial goals.

14. How can automation help me save and spend wisely?

Automation ensures savings are set aside first, leaving the rest available for spending without guilt.

15. Can I balance saving and spending with irregular income?

Yes, by basing your spending plan on your lowest expected income and treating extra earnings as savings or bonus spending.

16. Should I prioritize saving or paying off debt first?

Focus on high-interest debt repayment while also setting aside some money for savings to build financial security.

17. What role does an emergency fund play in balance?

An emergency fund ensures unexpected costs don’t derail your savings or lifestyle spending.

18. How much should I keep in an emergency fund?

Aim for 3–6 months of essential expenses, depending on your situation and stability.

19. How often should I review my saving and spending plan?

Review monthly or quarterly to adjust for income changes, new goals, or lifestyle shifts.

20. What tools can I use to balance saving and spending?

Budgeting apps like Mint, YNAB, and Personal Capital make it easier to track and plan.

21. Can a spending plan help me avoid debt?

Yes, because it ensures you live within your means and plan for expenses ahead of time.

22. How do I enjoy lifestyle spending without guilt?

Budget for it intentionally so you know it’s affordable and part of your plan.

23. What if my expenses are higher than my income?

Reassess your lifestyle, cut non-essentials, and look for ways to increase income.

24. Can I achieve financial goals while still enjoying life?

Absolutely. With balance, you can save consistently while enjoying the present.

25. How can I stop impulse spending?

Delay purchases, set limits, and focus on value-based spending instead of emotional buying.

26. Should I involve my family in a spending plan?

Yes, involving family ensures everyone is aligned with financial goals and spending priorities.

27. Is saving money more important than enjoying life?

Neither is more important—it’s about finding a healthy balance between the two.

28. Can I balance saving and spending with a low income?

Yes, even small savings matter. Start with what you can and grow as income increases.

29. What are sinking funds, and how do they help?

Sinking funds are savings pots for specific goals like vacations or car repairs, helping you plan lifestyle expenses without debt.

30. How does inflation affect saving and spending balance?

It increases costs, so you may need to adjust your plan to save more and cut unnecessary expenses.

31. Can balancing saving and spending improve my mental health?

Yes, financial stability reduces stress and allows you to enjoy life more fully.

32. What is conscious spending?

It’s intentionally directing money toward what brings value and cutting what doesn’t.

33. How do I handle unexpected expenses while maintaining balance?

Use your emergency fund or reallocate lifestyle spending temporarily.

34. Should I save before investing?

Yes, build an emergency fund and pay down high-interest debt before starting to invest.

35. How do I reward myself while saving money?

Include small indulgences in your spending plan, like a meal out or a small treat.

36. Can I use credit cards while balancing saving and spending?

Yes, if used responsibly—pay off the balance monthly to avoid interest.

37. How do I track progress toward balance?

Measure debt reduction, savings growth, and lifestyle satisfaction regularly.

38. What mistakes should I avoid when balancing saving and spending?

Avoid lifestyle creep, ignoring savings, or depriving yourself completely.

39. Can I balance saving and spending if I want to retire early?

Yes, but you’ll need to prioritize aggressive saving while still budgeting some money for enjoyment.

40. What’s the key to long-term success in balancing saving and spending?

Consistency, flexibility, and aligning money with your values ensure long-term success.

Also visit:-