Table of Contents

Introduction: How to Reduce Student Loan Debt: Proven Strategies for Graduates

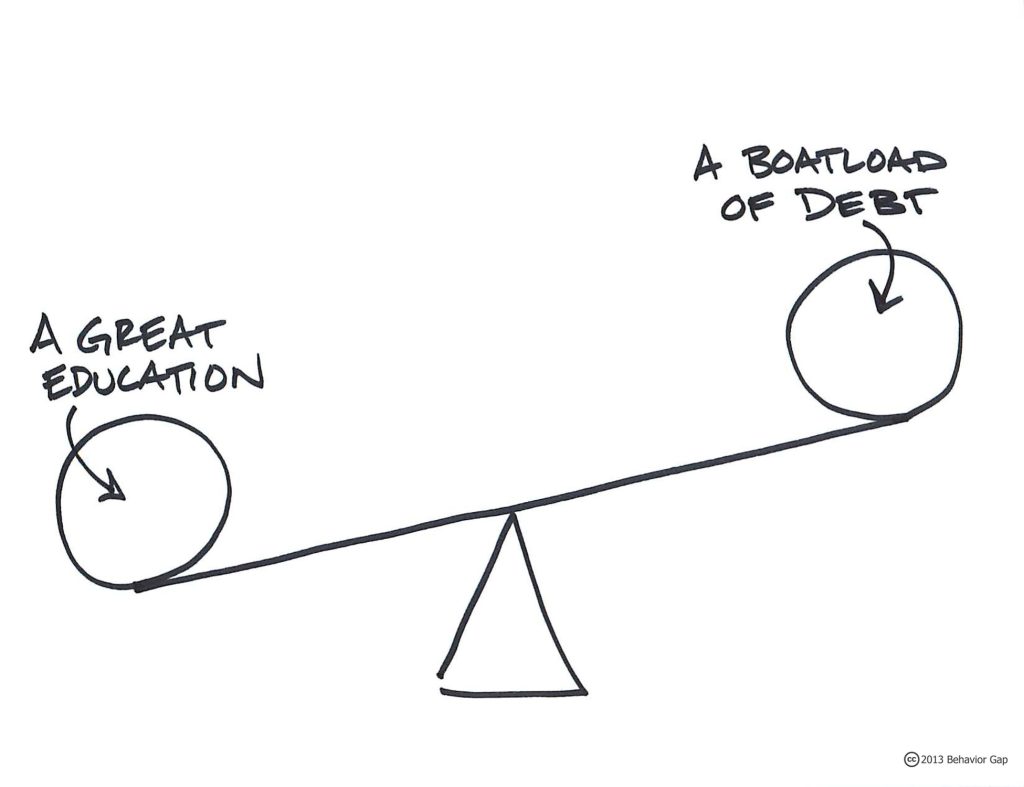

How to Reduce Student Loan Debt: Proven Strategies for Graduates: Eradicating student loan seems inconceivable given the rising costs of tuition fees and debt which graduates have to encounter in their early working phase. But that does not have to be the case since one can manage and even pay off most of the student loans. Here are several proven methods to help graduates reduce their student loan debt:Here are several proven methods to help graduates reduce their student loan debt:

1. Understand Your Loans

Understanding your student loans is the first process that one has to undertake when dealing with the issue of student loans. It is important that you learn whether you have federal loans or private loans, the interest rates, repayment terms and the total sum you owe. This information is useful because they guide one on what specific loans to pay first of course the rule of thumb is that those with higher interest rates are to be paid first.

2. Think of Dealing in Your Loans or Joining Your Loans.

Refinancing is when one acquires a new loan to repay other loans especially the student ones at a lower interest rate. This can be very handy in the long run especially in terms of how much you would have to pay in terms of interest on your loan. A large number of the private lenders provide a refinancing option, but this is primarily for borrowers who posses good credit ratings and steady income.

Consolidation on the other hand is a process where several federal student loans are grouped under one loan which the client pays periodically, usually monthly. This will not reduce your interest rate but it will combine your payments and may increase your repayment period hence the amount you have to pay to the institution every month will be reduced.

3. Choose an IDRP: The best strategy to repay the loans on time is by signing up for an IDRP program.

To understand the specific benefits that a borrower gets: For federal student loans, opting for an IDR plan will reduce the monthly payments you have to make to an amount that does not exceed a certain percentage of the borrower’s discretionary income. There are several IDR plans available, including:There are several IDR plans available, including:

Income-Based Repayment (IBR)

Most countries of the world adopted this system of taxation whereby people are taxed as they earn based on the Pay As You Earn (PAYE) system.

Pay As You Earn with Revised Amount (REPAYE)

Income-Contingent Repayment (ICR)

These plans are advantageous since, after making the under mentioned qualifying payments within 20 of 25 years, the balance is erased. On the same note, one should remember that amounts that have been forgiven are considered as income and therefore is taxable.

4. Explore Loan Forgiveness Programs

The following are the various loan forgiveness procedures through which a student can eliminate part of all the student debt. The most famous of them is the Public Service Loan Forgiveness (PSLF) programme, under which the remaining balance on the Direct Loans is written off upon the completion of 120 consecutive monthly payments while the borrower is employed by an eligible employer such as the government or a non-profit organisation.

Other forgiveness programs include:

Teacher Loan Forgiveness: It seems appropriate for teachers teaching in low income school.

Perkins Loan Cancellation: Some of the public service occupations.

5. A good practice about which there can be no doubt, or which does not require any elaborate discussion, is to pay more whenever possible.

The simplest way of repaying off your student loan faster is to pay a little more than the minimum payment every time you can. This way, you cut down the principal which leads to cutting down the amount of interest eventually to be paid. It isn’t the hundred dollar payments that can dramatically effect the total which you will be paying for your loan but even extra wee increases can significantly impact on the total that you will be paying.

Extra payments should be especially pointed out that we want the money to be credited to the principal. Otherwise, your servicer may apply it to future interest payments instead,” In other words, if you fail to follow the instructions on how to make your payments then your servicer may decide to use your payment to go towards your upcoming interest payments.

6. Spend Less Money Than You Earn and Be Smart in Spending

It is recommended that you should try to live a frugal life so that you are able to save more money which can then be used to pay off your student loans. Living on a budget is also very important to ensure all your expenditures are incremental and not weeding out all your money to unnecessary expenditures neglecting the loans. One should reduce the spending that is not required, one should not indulge in lavish living and should not spend more than what he earns.

7. Automate Your Payments

Most loan servicers give you a 0. 25% interest rate reduction for agreeing to be automatically deducted each month. Scheduling your payments will guarantee that the payment is made on time hence avoid incurring extra charges like late fees and other charges due to late payment. These small differences using continuously over a period of many years, if multiplied translate to big savings in terms of your loan.

8. Employer Repayment Assistance Programs ‘ERAPs’ Booking Should Be Taken

Payment of the student loans is another form of benefit that some employers extend to their employees. This usually entails the employer direct paying of your student loans with an annual limit. If your employer provides this sort of luxury, then you should major on it – it is actually free money that can be used to clear your debts.

9. In this case, we should try to find Side Income Opportunities

One of the best ways to have an extra stream of income that can go to the paying off of student loans is to look for a side job or a part time job to do. It is still possible to earn this kind of money by freelancing or participating in gig works such as tutoring or driving a car for a ride-hailing service; the earnings from such side hustles could be used to pay for the debt and thereby speed up the process.

10. You might want to consider having a move to a locality that has a low cost of living index.

If you are experiencing pressures due to high living expenses you can relocate in a new area of residence with relatively low cost. This can help to release more of your income for debt payment. Unfortunately, relocation may not be as possible for everyone, but I invite my readers to assess if they are free to choose their workplace’s location.

11. WE HAVE to make sure that we take advantage of the tax deductions available so that the money can be used for the intended purpose of improving the welfare of the people of the State.

Student loan interest is allowed up to a maximum of $2,500, the limitations however depend on your adjusted gross income and other factors on your federal tax return. Even if you don’t claim the standard deductions for itemizing on your taxes and it gives you some leeway on your taxes and helps you to set aside more cash for loan repayment.

12. It is however, advisable to avoid Deferment and Forbearance if at all possible as they will cost you more money in the long run.

While options such as deferment or forbearance might be helpful because they give borrowers time without having to make monthly payments, interest does not stop adding up and this results to a higher loan balance. If you possible, one should continue and continue to make the payment despite the fact that this might be for limited amount.

13. Use Windfalls Wisely

If for instance, you get a tax rebate, a bonus at work or an inheritance, then you should use this money to pay off your student loans. A huge amount of payment is erases a large portion of your principal balance where interest and repayment is calculated hence enabling faster repayment.

14. Seek Professional Financial Advice

In the case where your student loan burden appears too large to manage, you may wish to seek the advice of a financial planner. They will be also able to develop a strategy on how to deal and minimize your debts, as well as other issues concerning debt, saving for retirement or purchasing a property.

15. And in general, it’s important to remain as up-to-date as possible about the changes in student loan policies.

It is also important to note that there are policies and programs for student loans and programmes for student loans may alter with new legislations. Always keep abreast on any changes that may affect one’s ability to pay off the loans or even meet the requirements for the forgiveness programs. This knowledge can help you shift your repayment plan as and when necessary.

16. Pay Off High-Interest Debt As A Priority

In case you’re struggling with paying for several loans simultaneously, you should focus on the debt with the highest interest rate. This one knowning as the ‘avalanche method’ is the one that saves the most money on interest in the long run. After paying of the high interest loans, one can thereafter channel his payments towards the next higher interest rate loan.

17. Take a house within a family vicinity

Although impossible for many people, learning with the parents helps you save a lot on the housing, so the excess money can go to the student loan. If returning to your parents’ home is possible and if you have the intention to pay off your debts as soon as possible then it will be beneficial for you.

18. In this respect, clients should take advantage of grace periods in order to make as many payment arrangements as possible.

If one is still within the grace period after graduating, it is high time to begin making the payments. Interest usually compounds during this period, and timely payment will, therefore, help in minimizing the total that one will pay.

19. Reevaluate Your Budget Regularly

People’s financial status changes, so it is necessary to revise the created budget as frequently as possible. When your income rises or expenses sink in, you have an option to shifted budget plan to provide for more fund to pay your student loan.

20. Please view Loan Repayment Assistance Programs by State

Most states have known as loan repayment assistance programs (LRAPs) for their residents who work in some particularly designated fields of practice including health, teaching or any government service. That is why these types of programs can be really useful in order to reduce the loan balance on your credit reports you agree to work in that particular field for the specified number of years.

21. Why It’s a Good Idea to Pay More than the Minimum Amount Due

In as much is possible one should pay beyond the minimum amount required on your loan balance. This helps to repay your principal more early enough thereby cutting the interest expenses and the repayment period as well.

22. Switching to a Bi Weekly Remittance Schedule Might Be a Good Idea

Biweekly payments which will be half of the monthly payment are more effective to avoid the stress of having to make a lump sum payment at the end of the month. This approach leads to one additional monthly payment per year thereby leading to shortening of your loan period and therefore, interest charged.

23. Here, learn if it is possible to have some of the loans overlooked in exchange for volunteer services.

: There are some organizations such as AmeriCorbs, whereby volunteers are repaid by granting them student loans. The reward in terms of money is not as big as it is in other programs but it is nevertheless an ideal way of rebating to society as you get to have your debt reduced.

24. If You’re a Lawyer, Try a Loan Repayment Assistance Program (LRAP).

For a lawyer, there are certain Which has to do with LRAPs that can assist anyone in controlling several other student debt loans. These programmes are usually available for those who practice in the areas of public interest law or other equivalent fields.

25. Keep a Positive Mindset

Lastly, attitude here as part of the plan and goals, and here it means that one must remain positive all the time and focused on the goal. He said, “To cut down the student loan debt, it is not something that is going to happen overnight but more like a long distance run. ” To underscore this point, don’t forget to encourage yourself every once in a while throughout the journey of making yourself debt-free.

You will be able to enjoy financial freedom if you get to apply these strategies when dealing with your student loan. This may take some time and push-up but the benefits that accompany the experience include peace of mind and good financial returns.

FAQs on “How to Reduce Student Loan Debt: Proven Strategies for Graduates”:

- What is the first step in reducing student loan debt?

- The first step is to fully understand the details of your loans, including whether they are federal or private, the interest rates, repayment terms, and total amount owed. This knowledge will help you create an effective repayment strategy.

- What is loan refinancing, and how can it help reduce student loan debt?

- Loan refinancing involves taking out a new loan with a lower interest rate to pay off existing student loans. This can reduce the amount of interest paid over time, saving you money.

- What is loan consolidation, and when should I consider it?

- Loan consolidation combines multiple federal student loans into one loan with a single monthly payment. It simplifies your payments and can extend your repayment period, potentially lowering your monthly payments.

- How do income-driven repayment (IDR) plans work?

- IDR plans cap your monthly payments at a percentage of your discretionary income and extend your repayment period. After 20-25 years of qualifying payments, any remaining loan balance is forgiven, although the forgiven amount may be taxable.

- What are the different types of IDR plans available?

- The main IDR plans include Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR).

- What is Public Service Loan Forgiveness (PSLF)?

- PSLF forgives the remaining balance on your Direct Loans after you make 120 qualifying payments while working full-time for a qualifying employer, such as a government or nonprofit organization.

- How can making extra payments help reduce student loan debt?

- Making extra payments directly toward your loan principal reduces the overall balance, which in turn reduces the amount of interest you’ll pay over time.

- What should I do with financial windfalls like tax refunds or bonuses?

- Consider using financial windfalls to make lump-sum payments on your student loans, especially those with higher interest rates. This can significantly reduce your principal balance.

- Can living below your means help reduce student loan debt?

- Yes, by living below your means and creating a budget that prioritizes loan payments, you can free up more money to pay off your debt faster.

- Is automating payments beneficial for student loan repayment?

- Yes, many loan servicers offer a small interest rate discount (usually 0.25%) for enrolling in automatic payments, which ensures you never miss a payment.

- What are employer repayment assistance programs?

- Some employers offer student loan repayment assistance as a benefit, where they make direct payments toward your student loans. This can significantly help reduce your debt.

- Can side hustles help pay off student loans faster?

- Yes, income from side hustles or part-time jobs can be dedicated solely to student loan payments, accelerating debt repayment.

- What are the tax benefits of paying student loan interest?

- You can deduct up to $2,500 of student loan interest paid on your federal tax return, which reduces your taxable income.

- Should I avoid deferment and forbearance?

- If possible, yes. Interest often accrues during deferment and forbearance, increasing your total loan balance. Continuing to make payments, even reduced ones, is generally better.

- Can refinancing my student loans affect my credit score?

- Refinancing may have a minor impact on your credit score due to the hard inquiry made by lenders, but it can also improve your score over time if it lowers your overall debt burden.

- How does biweekly payment scheduling work?

- Making biweekly payments instead of monthly payments results in one extra payment per year, which can reduce your loan term and save on interest.

- Can I deduct student loan payments from my income taxes?

- While you cannot deduct the payments themselves, you can deduct up to $2,500 of the interest paid on student loans, provided you meet certain income requirements.

- How can loan forgiveness for volunteer work help reduce debt?

- Programs like AmeriCorps offer student loan forgiveness in exchange for volunteer work. While the financial benefit may be modest, it’s still a viable option for reducing debt.

- Is it beneficial to pay more than the minimum payment?

- Yes, paying more than the minimum helps reduce your principal balance faster, saving you money on interest and shortening your repayment period.

- What is the avalanche method in debt repayment?

- The avalanche method involves focusing on paying off loans with the highest interest rates first, which minimizes the amount of interest paid over time.

- How can moving to a lower cost of living area help reduce student loan debt?

- Lower living expenses free up more income to put toward student loan payments, helping you pay off your debt faster.

- What is the advantage of making payments during a loan’s grace period?

- Making payments during the grace period (typically six months after graduation) reduces the amount of interest that will accrue, lowering your total repayment amount.

- Are there state-specific loan repayment assistance programs?

- Yes, many states offer loan repayment assistance programs (LRAPs) for residents working in specific professions, such as healthcare or education, which can help reduce your loan balance.

- Can financial advisors help with student loan repayment?

- Yes, a financial advisor can help you create a personalized plan to manage and reduce your student loan debt, as well as provide advice on other financial matters.

- Why is it important to stay informed about student loan policies?

- Student loan policies and programs can change over time, and staying informed ensures you can take advantage of new opportunities or adjust your repayment strategy as needed.

Also visit:-